Who Else Wants Tips About How To Become A Financial Planner Canada

Canadian investment advisors have earned a college degree in business, finance, economics, or a related.

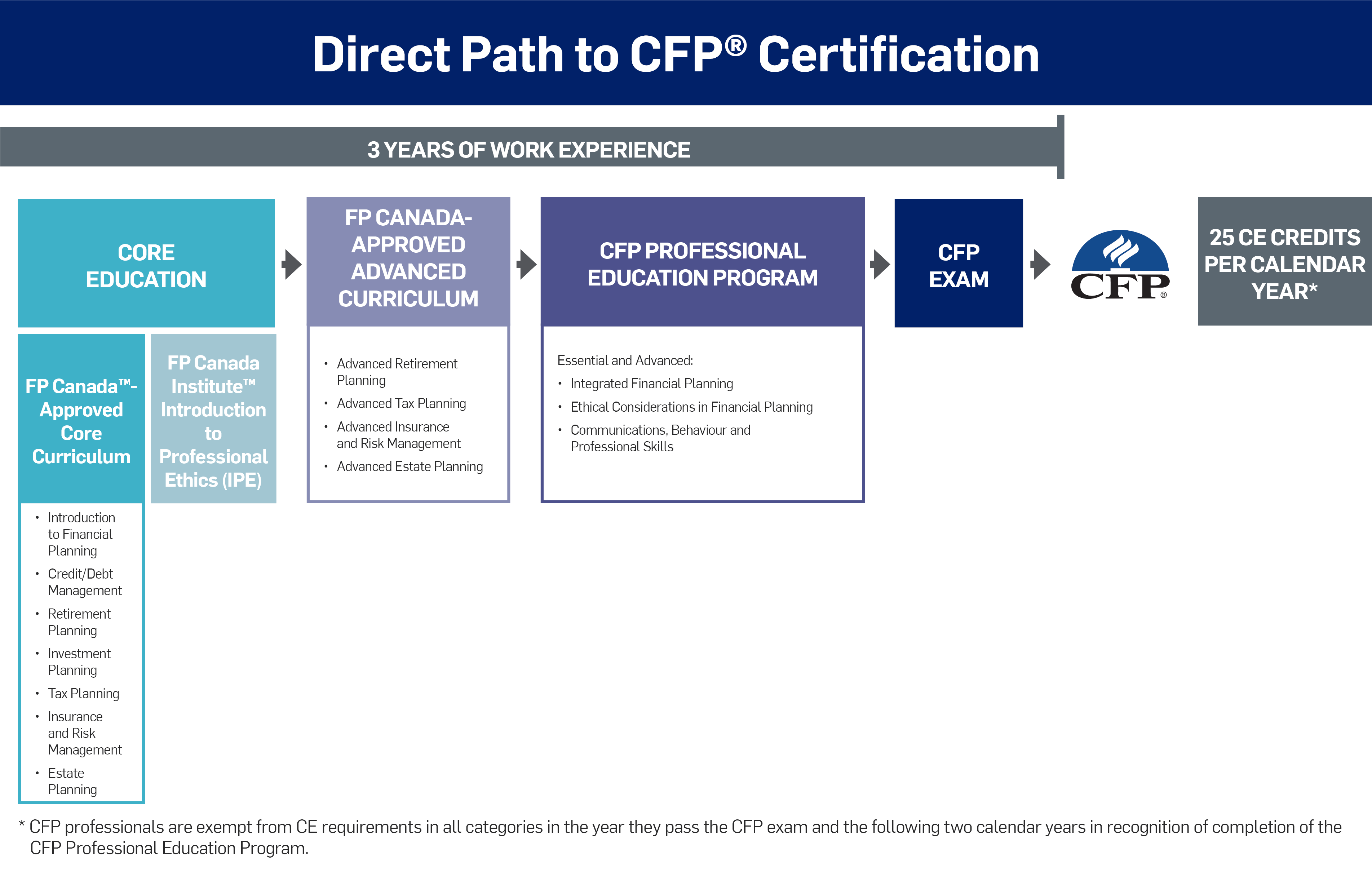

How to become a financial planner canada. They help people save for their future and make wise investment choices. To acquire cfp certification, you must have three years of qualifying financial planning experience at the time of application. This could include an employee of your financial institution, a stock broker or an.

You will need to complete an academic program related to finance or economics before you become a financial advisor. Earning a certification may take a few months to over a year. To acquire cfp certification, you must have three years of qualifying financial planning experience at the time of application.

Becoming certified as a financial planner in canada since cfp certification is the standard for the industry across all of canada, the process is explained in detail here. They must also complete at least a year of qualifying work experience and pass a national exam. Becoming a financial advisor in canada.

Generally speaking, if you find a cfp (certified financial planner) or an rfp (registered financial planner), you can trust that you are in good hands. A bachelor's degree typically takes four years to complete. Professional financial planners help manage their clients’ everyday and complex financial needs to help.

Qafp™ certification provides a quicker path to becoming a professional financial planner, and it can be a stepping stone to earning your cfp certification. With a qafp designation, you’ll be. Next, you need at least a year of work experience.

This can be in the form of a certificate, diploma, or degree. When you’ve completed all of the. Becoming a financial advisor can be a rewarding career choice;

:format(webp)/https://www.thestar.com/content/dam/thestar/business/2022/03/23/ontario-to-regulate-use-of-financial-advisor-planner-titles-regulator/20220323090312-623b1ca82d2f2235b1d85fb5jpeg.jpg)

/financial_advisor_calculator-5bfc2eff46e0fb00517c8ba3.jpg)

![Evolve Or Dissolve: Rethinking What It Means To Be A Financial Planner With Cary List [Ep34]](https://static.wixstatic.com/media/56c6b0_04a23554dcc346aeaee6f7214d7b2b34~mv2.png/v1/fit/w_1000%2Ch_720%2Cal_c/file.png)