Recommendation Tips About How To Get A Bid Bond

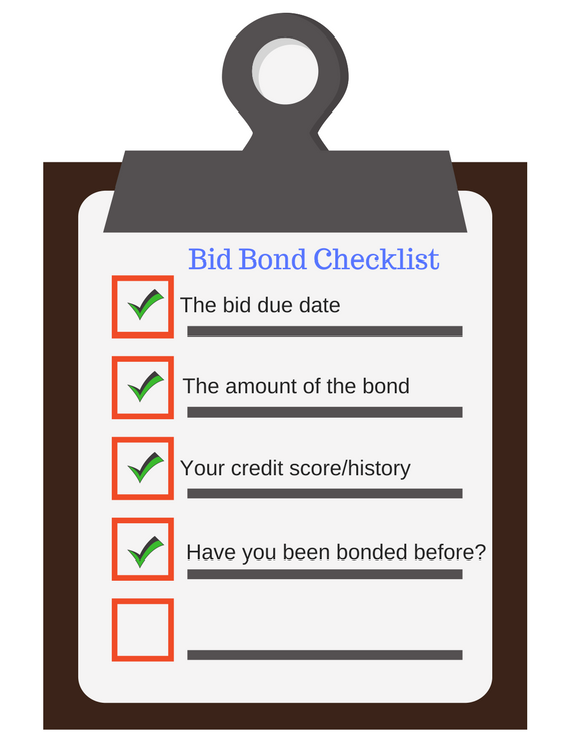

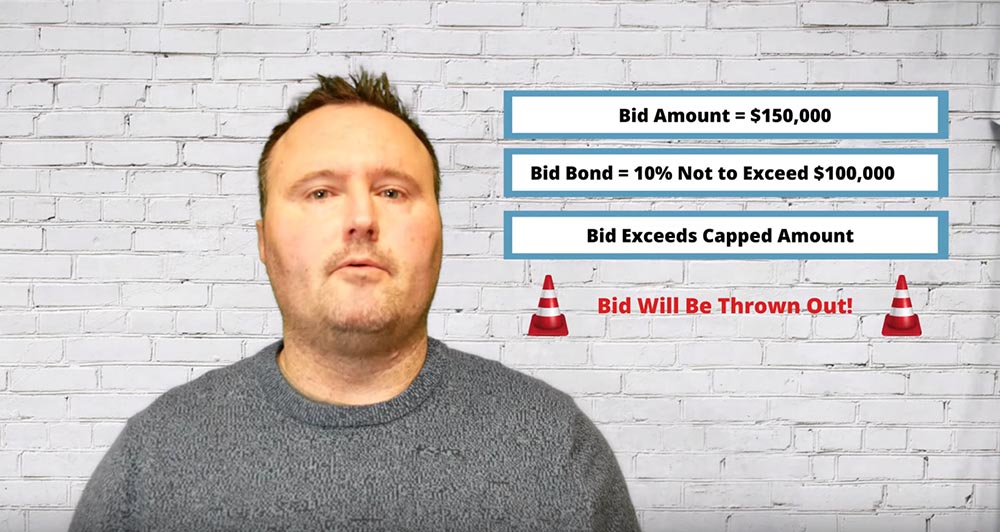

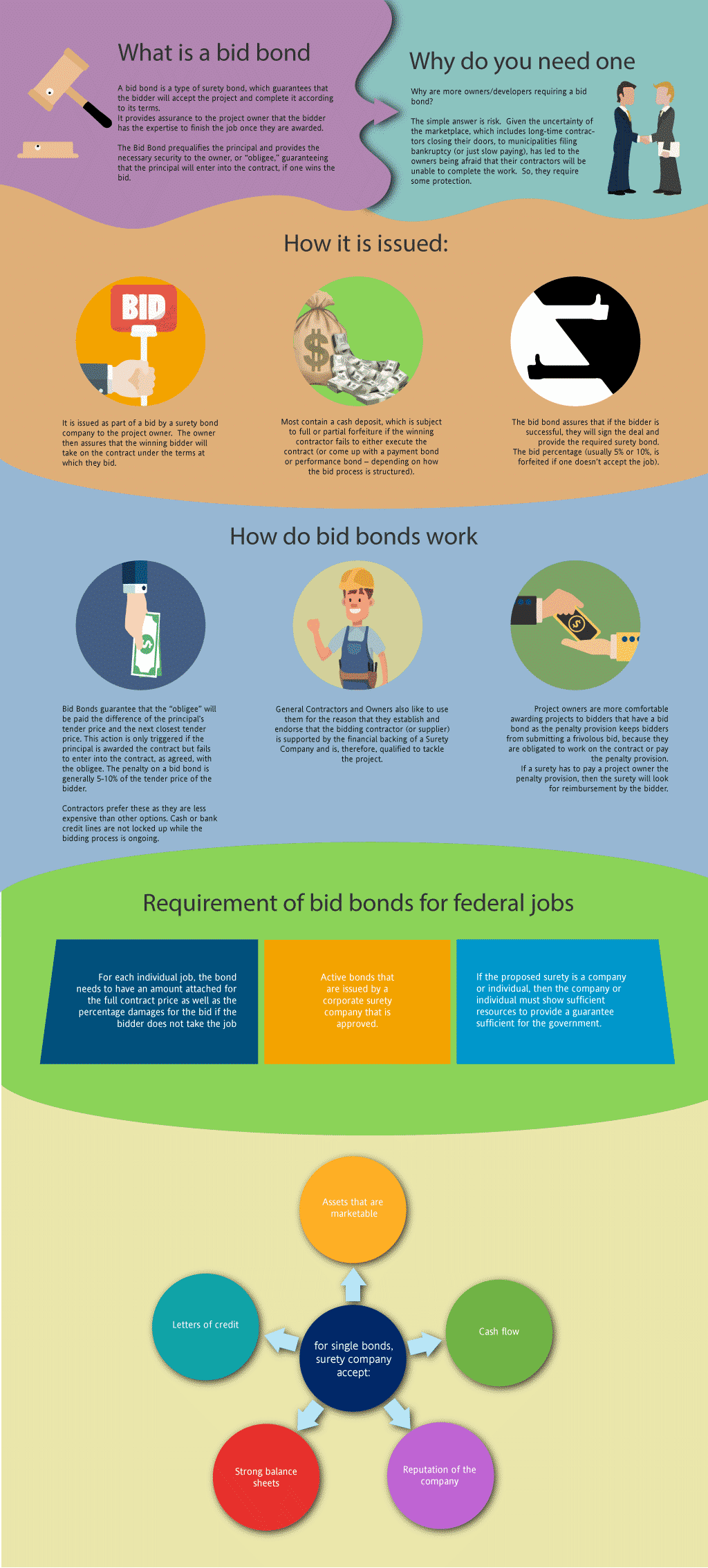

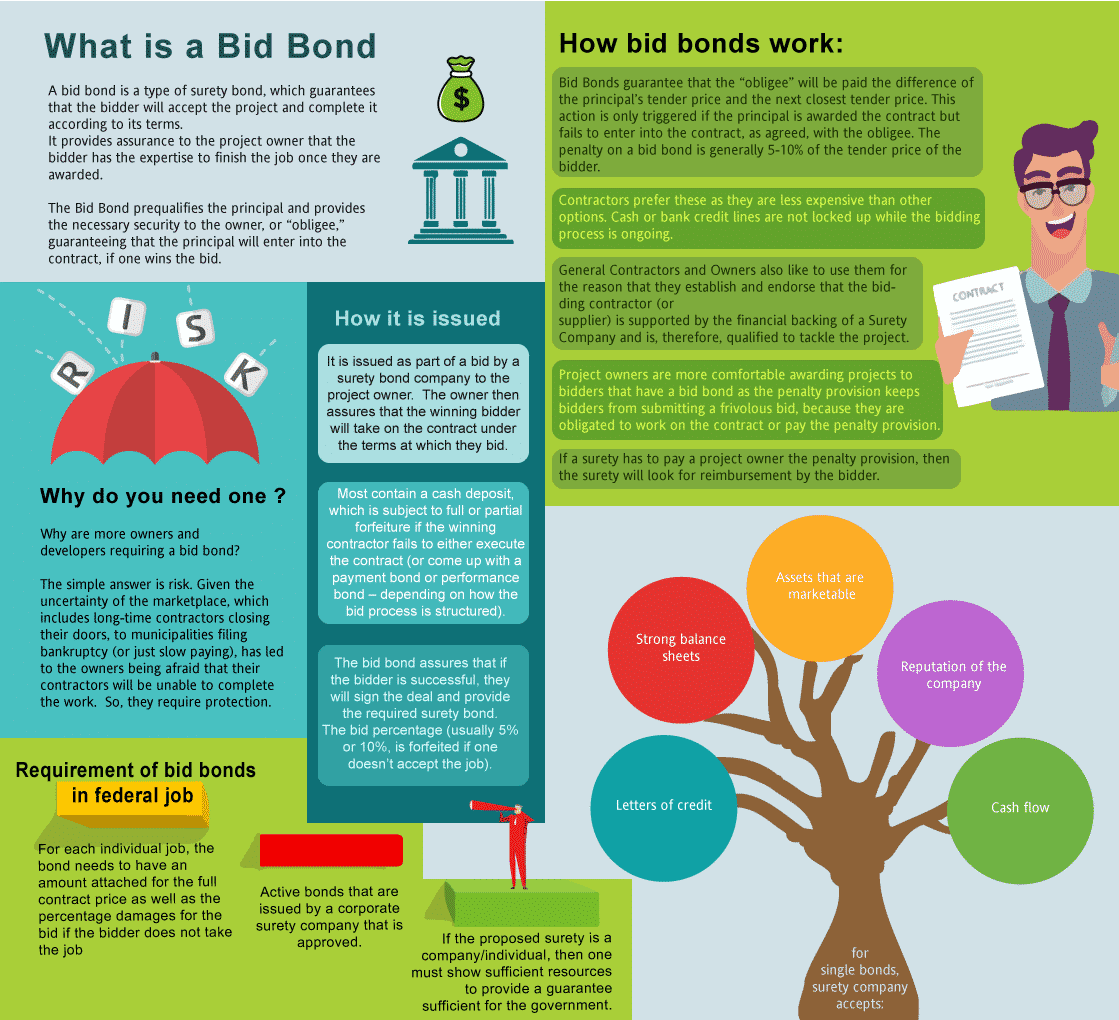

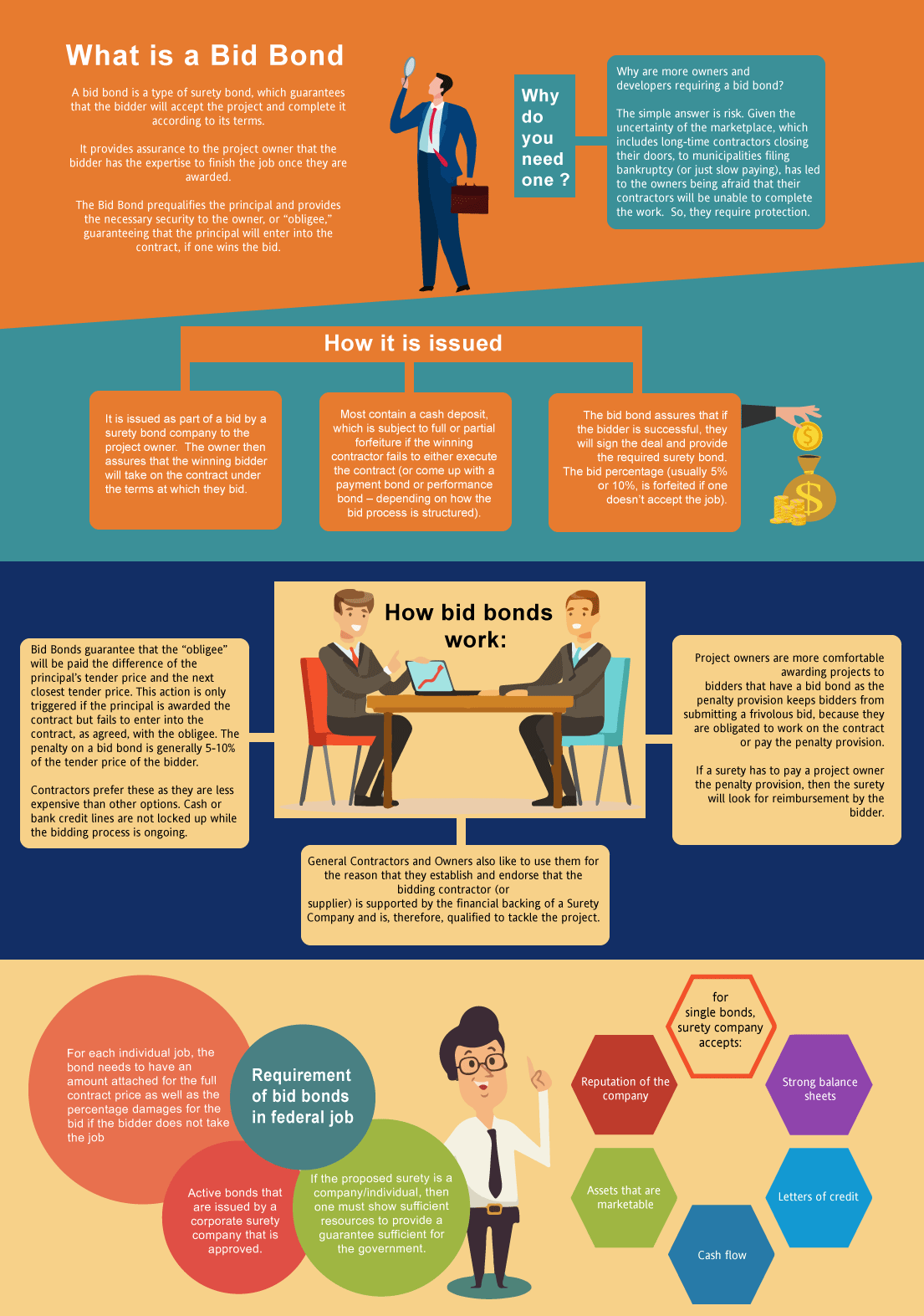

The amount of bid security required is determined by the project.

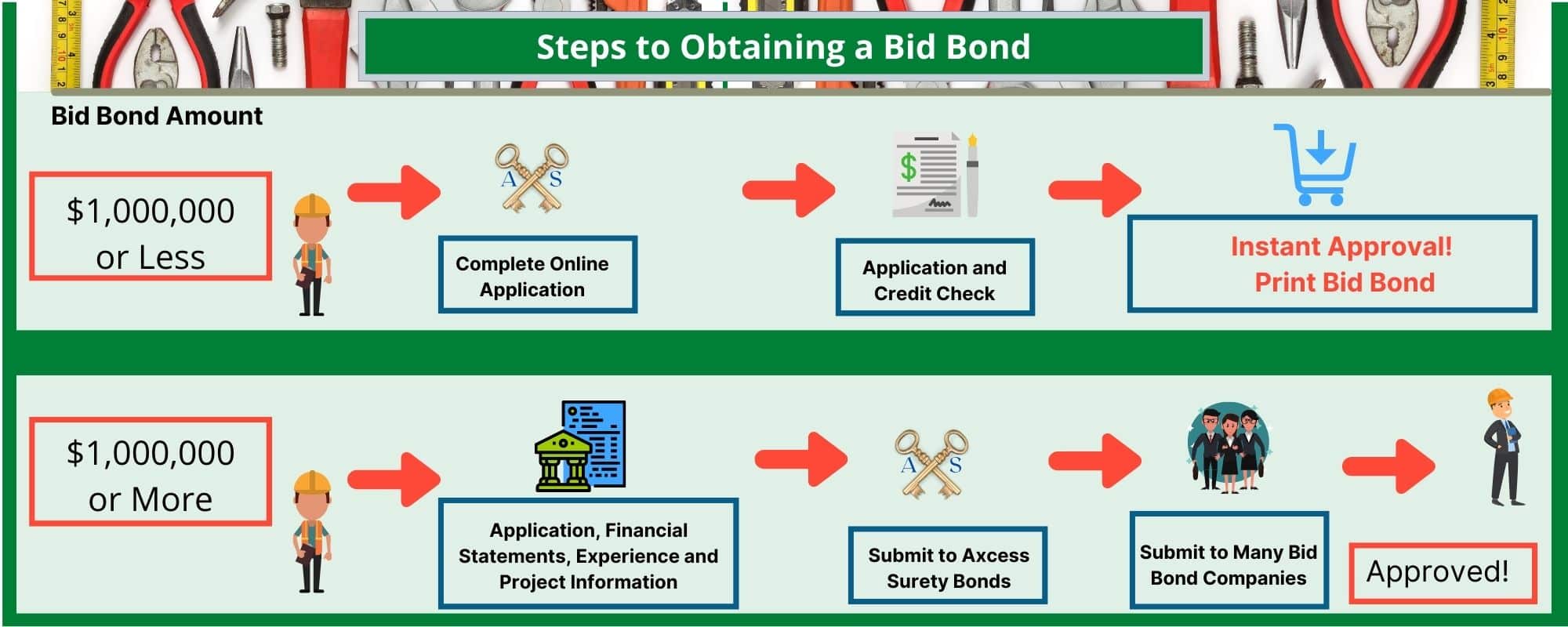

How to get a bid bond. As mentioned previously, the bid bond is a form of bid security. One way is to contact an insurance company or bonding company and ask for a quote. We have the fastest release, agents always on time.

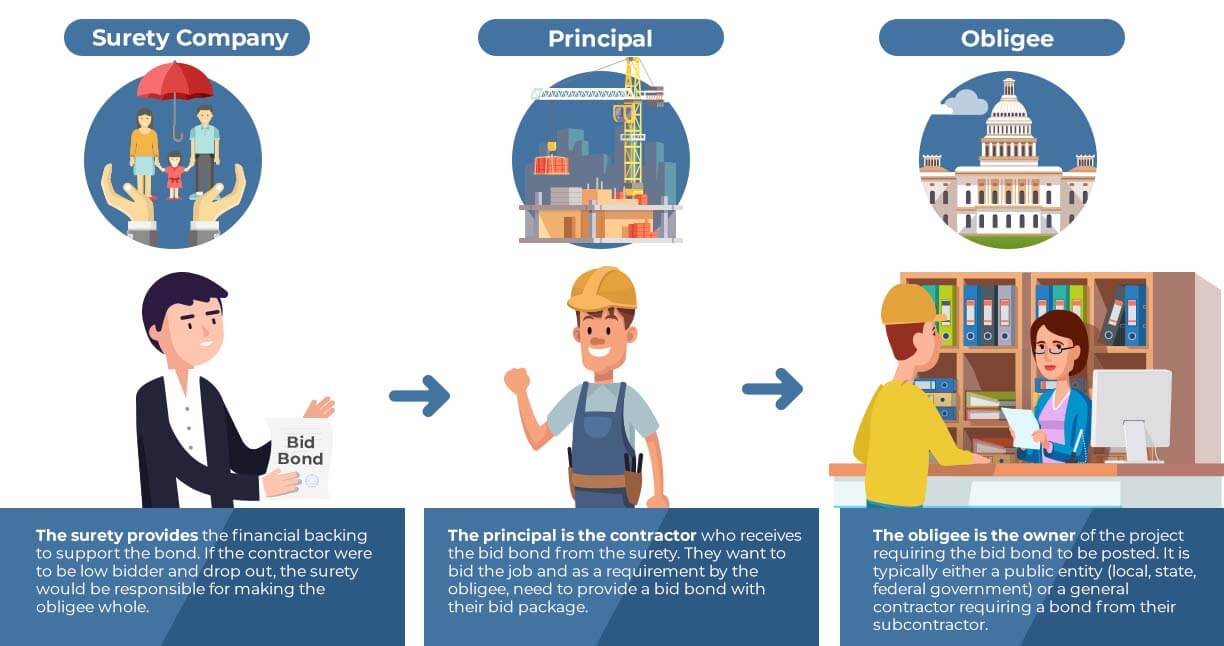

This form is intended for use by government contractors and contracting personnel for compliance with and management of financial security requirements in federal. Get your bid bond today! To allow more recent firms to bid when bonds must not available, the miller act allows the company to publish a money deposit of 20 p.c of the bid in lieu of a quote bond.

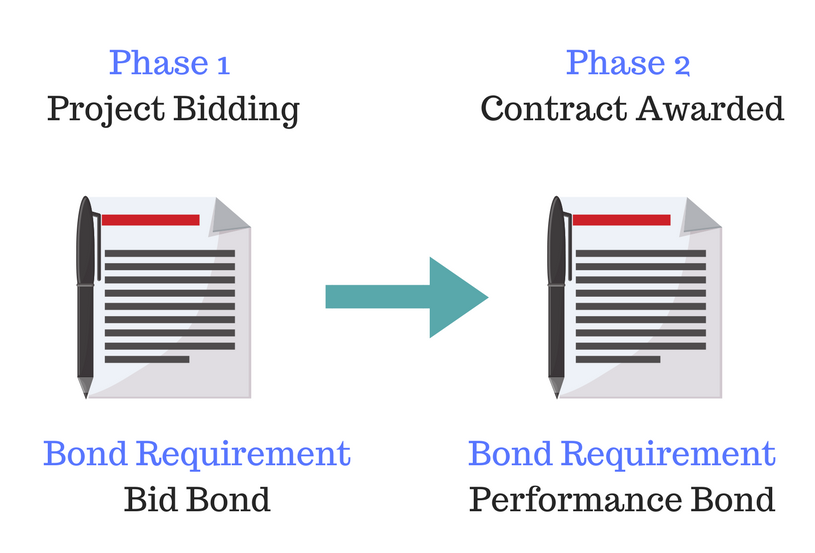

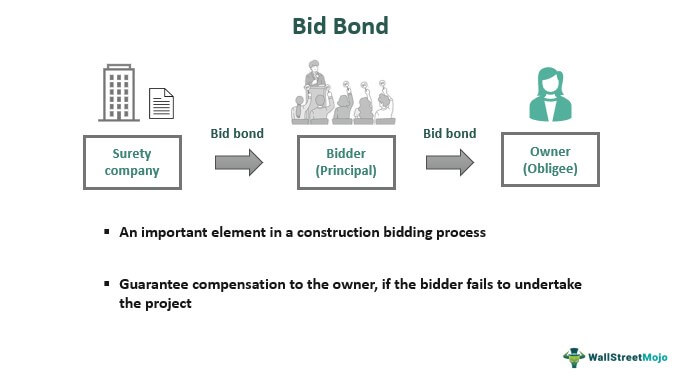

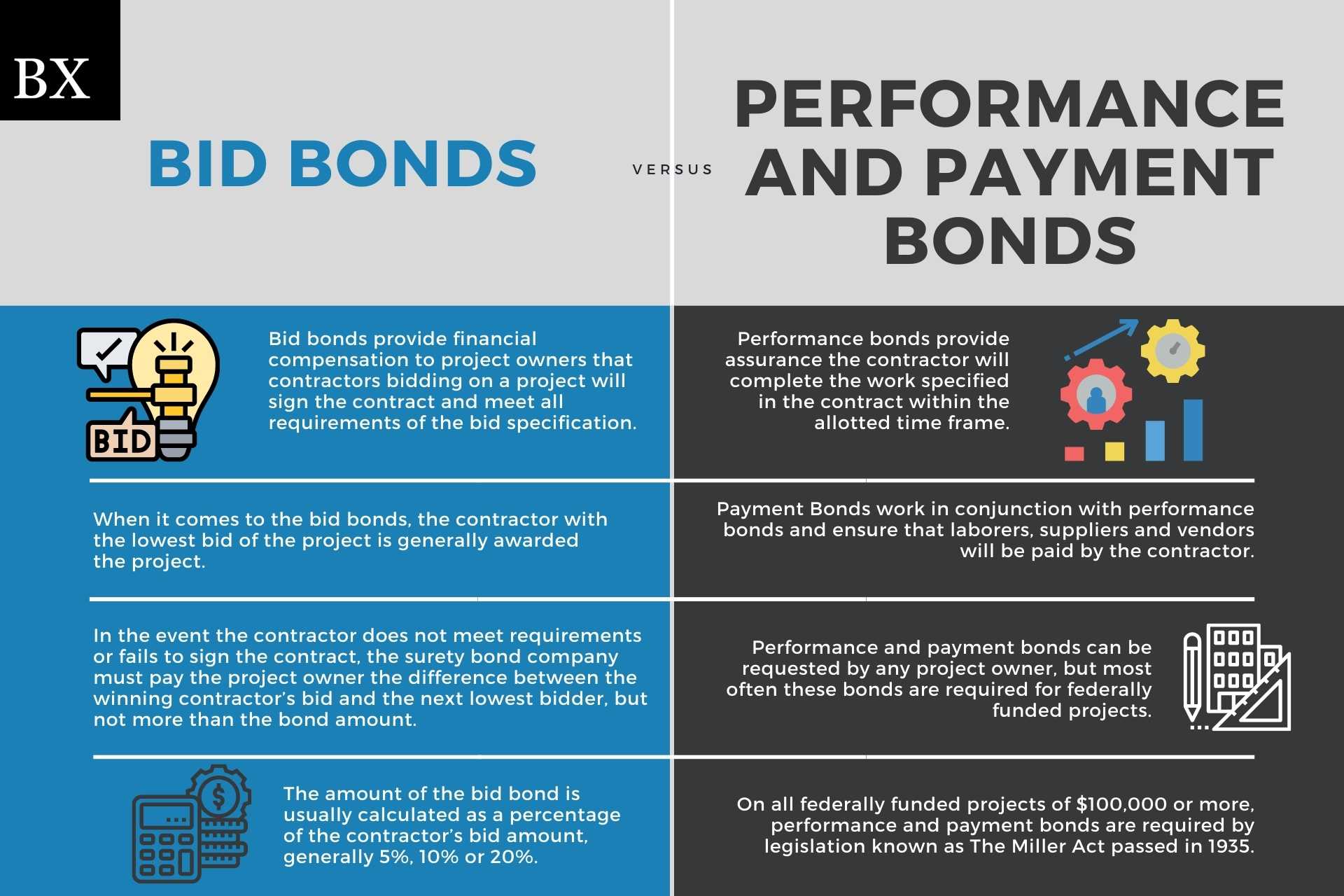

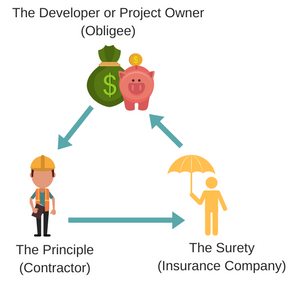

A contractor purchases a bid bond from a surety, which carries out extensive financial and background checks on a contractor before approving the bond. Another way is to contact the contractor. We learned that project owners can ensure they pick qualified bidders by requiring a bid bond.

The bid bond amount is easy to calculate. Your underwriter will issue the bid bond once financial records have. We have the fastest release, agents always on time.

99% approval rate for all credits. If you plan to submit a bid above $250,000, there will be additional financial credentials needed to process your application. However, the bid bond does not protect the project owner beyond the bidding.

See how much you save on your bond! Most owners specify the requirement for bid security of 10% of the contract price in the form of a bid bond, irrevocable letter of credit or certified cheque. A bid bond is typically obtained through a surety agency, such as an insurance company or bank, and it helps guarantee that a contractor is financially stable and has the.

![A Guide To Bid Bonds [Infographic] | Viking Bond Service, Inc.](https://www.performancesuretybonds.com/blog/wp-content/uploads/2020/10/BidBonds-scaled.jpg)